- Activator -Quiz

- TPS Brainstorming:

- What are depository institutions?

- List the 2 types of depository institutions.

- What should we look for when comparing depository institutions?

- Comparing the 2 types

- What features of checking/savings accounts are most important to you?

- Discussion Question - How can we find this information to help us make personal finance decisions?

- Finding the perfect financial institution for you.

- Demo - PSECU

- Google depository institutions near Mount Joy, PA

- Select 3 depository institutions to research

- At least 1 must be a commercial bank

- At least 1 must be a credit union

- Research each selected depository institution's website for key information

- Place this information in the appropriate location on the advanced organizer

- Determine which depository institution best meets your personal requirements.

- Use Google Docs & Explain how you determined your decision (2-3 paragraphs)

- Create a new document

- Name it Last Name - Deposit Choice

- Share with justin.hill@staff.donegal.k12.pa.us

- Revise your composition accordingly (MAKE IT THE BEST EVER!!!)

- Summarizer - TOD

- What factors were most important to the decision? Why?

- What was the most difficult aspect of making this decision? Why?

Thursday, October 30, 2014

Choosing a Depository Institution

EQ - What factors should be considered when choosing a savings plan?

Monday, October 27, 2014

Intro to Banking Systems

EQ - How can bank accounts benefit me?

- Activator – How does the banking system work

- Draw and

label a picture of how you believe the banking system works

- Chalk Talk – How banks work

- AP – Update your picture

and summarize how banks work on the back of your paper

- Activator

– Money Matters (YouTube music video)

- Active Reading TPS - I'm

the Biggest Boss (of my money)

- Discussion Question - Why is it important to

open a bank account?

- AP – Reading

Response Questionnaire

- What are

savings and checking accounts, and how do they differ?

- How can

opening a bank account help you learn to budget?

Why is this important, especially if you use a debit card?

- Discussion

Question - How do you know which bank is right for you?

- Shared Inquiry - Did

You Know

- Identify unknown words

- Identify questions you have

- Discussion

- AP - Top

3 - Identify and Rank

- Students partner up to list as many reasons as

they can to explain why bank accounts are important.

- Groups will list reasons on the board and then explain

why they believe their group has the best reasons.

- TOD - Students will individually rank their top 3

reasons that teens should learn about banks and bank accounts?

Friday, October 24, 2014

Unit 4 Exam

EQ - How are budgets used to make wise financial decisions?

- Mini-lesson - Brainstorm the major budget categories and the average allocation percentages

- Q & A

- Unit 4 Exam

- Submit any missing assignments

- Learn Something New

- Visit THIS WEBSITE

- Choose a new story

- Actively read the article

- Write a Summary & Analysis of the article

- In MS Word

- 2 paragraphs

- Be complete

- Test Feedback

Thursday, October 23, 2014

Budgeting Review

Complete a budget

Study Guide Creation

Wednesday, October 22, 2014

Sonny Letter

Directions

- Review your letter to Sonny.

- Identify all comments that apply to your letter.

- Copy and paste the comments that apply to the bottom of your letter.

- Revise your letter to make it amazing!

- Be sure this letter has been shared with justin.hill@staff,donegal.k12.pa.us

- When you have finished, please review the Unit Map and begin preparing a study guide.

Sonny Advice Letter Comments

- Organize your multiple ideas into multiple paragraphs (1 main idea per paragraph).

- Watch out for run on sentences.

- How can calculating the percentages spent on each category better convince Sonny to follow your advice? Implement these calculations when necessary.

- How does your recommended control system work? Can you provide a description of what this may look like for Sonny?

- Check your spelling and grammar (sometimes even spell check misses errors).

- You convinced me to review some items in my budget!

- You may want to be nicer to Sonny; its only his first time budgeting.

- Great job! Sonny is lucky to have you!

- With some revision, this will be the best letter of advice ever!

- Feel free to ask for help if you need it. I will gladly meet with you during a Tribe Time to help you with this composition.

Monday, October 20, 2014

Budgeting Advice

EQ - How is a real life budget created, evaluated, and adjusted?

- Activator - TPS Splashdown

- AP - Collaborative Teams - Questionnaire

- What are the similarities between the Brown Family's expense allocation and the average expense allocation?

- What are 2 differences?

- AP - Debriefing - White Board Response

- What 3 steps of budgeting are for PLANNING?

- Which category allocation from the scenario most alarms you?

- What makes it alarming?

- Activator - TPS: Mint.com Budgeting Gadget

- Evaluating a budget

- Sample Budget *

- Review Control Systems

- The evaluation process* (Together)

- AP - Financial Advice - What advice would you give to Sonny? Be specific and detailed *

- Google Docs Instruction Sheet

- Letter Directions

- Composition Work Time

- Self-Evaluation

- What kind of spender are you?

- How can the result of this quiz help you when planning your personal budget?

- TOD

- Review the Unit Map

- Develop a Strengths and Weaknesses Chart to assess your current comprehension of Unit 4 objectives

- How can you use this information to prepare for your Unit Exam

Thursday, October 16, 2014

Intro to Budgeting

EQ - How are income and expenses classified?

EQ - How is a budget created?

- Activator - Chalk Talk

- What do adults pay for on a monthly basis?

- White Board Groups - Estimations

- Mini Lesson - Cash Flows

- Spending Plan - Advanced Organizer

- Spending Plan - PowerPoint

- Classifying Income and Expenses (LEQ 1)

- Spending Plan Development Process (LEQ 2)

- Components of Spending Plans (LEQ 2)

- Identifying Spending Plan Components (LEQ 1 & 2)

- TOD - Today's Meet (CLICK HERE FOR LINK)

- List the steps of creating a spending plan.

- Muddy Points

Tuesday, October 14, 2014

Unit 3 Exam and Intro to Unit 4

- Q & A Review

- Unit 3 Exam

Unit EQ - How are budgets used to make wise financial decisions?

LEQ 1 - How are income and expenses classified?

LEQ 2 - What are the steps to develop a budget?

Please access your laptop & visit the class website

- Activator - Chalk Talk

- What do adults pay for on a monthly basis?

- White Board Groups - Estimations

- Mini Lesson - Cash Flows

- Spending Plan - Advanced Organizer

- Spending Plan - PowerPoint

- Classifying Income and Expenses (LEQ 1)

- Spending Plan Development Process (LEQ 2)

- Components of Spending Plans (LEQ 2)

- Identifying Spending Plan Components (LEQ 1 & 2)

- TOD - Today's Meet (CLICK HERE FOR LINK)

- List the steps of creating a spending plan.

- Muddy Points

Tuesday, October 7, 2014

Thursday, October 2, 2014

Minimum Wage Laws

EQ - How do current minimum wage laws affect your pay?

- Activator - Q&A

- Quiz - Calculating Pay

- Activator: LINK

- List - TPS- What do you know about minimum wage?

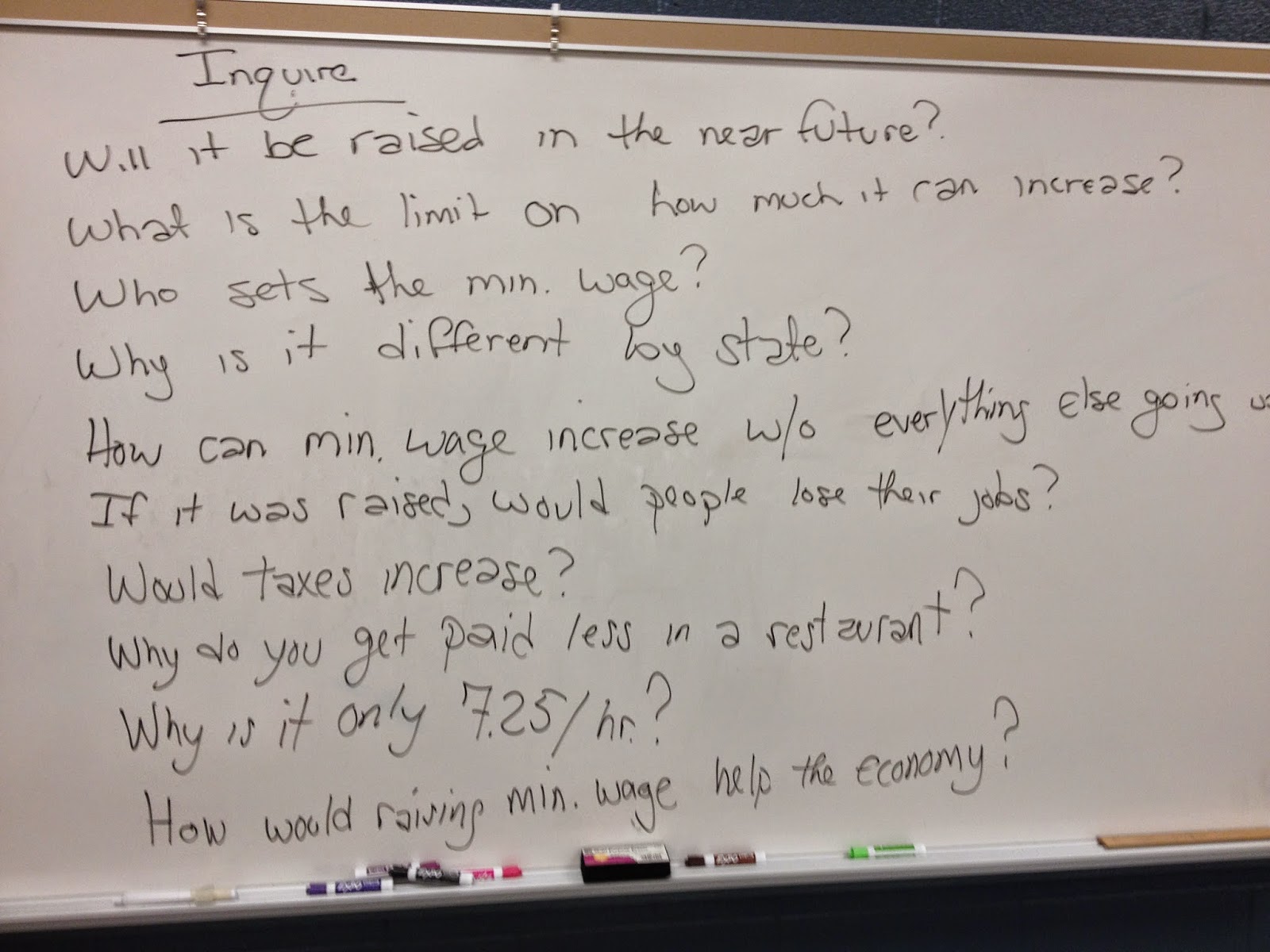

- Inquire - TPS - What questions can be formed from this list?

- Read "The Impact of $9 Minimum Wage"

- Collaborative Groups - Discussion - What's the big deal about minimum wage?

- Note - Make Notes about your discussion. Look for answers to our inquiry questions, connections to what you already know or heard about in our discussion, and new questions that arose as you read.

- Know - Write a short explanation (140 characters or less) of what you now know about minimum wage.

- Discussion - How has your understanding of minimum wage changed as a result of the reading and discussion?

- Developmental Activity - Can You Survive?

- TPS - Before you begin

- Explain your opinion of a job that will pay your $9/hr.

- Would you be able to provide for yourself at this hourly rate?

- The Experience - Can You Survive?

- TPS - What was this experience like for you?

- Has your perception changed? Why or why not?

- Additional Reading - Federal Minimum Wage Laws

- Assessment - Compose a letter to your state representative

- Identify your state rep.

- Discuss the minimum wage debate

- Propose a recommendation for how your rep should vote on minimum wage law changes

- Provide evidence to support your recommendation

Subscribe to:

Comments (Atom)